We had 0 plans to build payment infrastructure in Africa.

When we set out on a journey to build NALA, we spent hundreds of hours interviewing more than 600 people.

We learned customers care about 3 things:

- FX rates 💰(price) — customers care about foreign exchange rates to ensure their money goes as far as possible.

- Speed of transfer ⚡ — they want money to arrive as close to real-time as possible.

- Payment reliability 💪🏽 — they care about money arriving promptly and are willing to pay a premium for reliability.

Initially, we thought it would always be in that order. Soon, we learned that, over time, to retain customers, as long as you are within 0.5%-1% of the next best competitor on FX, reliability is what really matters.

FX rates matter for getting users in the funnel, but reliability is what keeps them there, and what’s more, customers are willing to pay for reliability.

When you scale, so do your problems 🚨

When starting up or expanding into a new market, we would plug into existing payment networks, banks and aggregators. Over the past two years, our consumer fintech app grew 28x and has enabled customers in the US, UK and EU, to seamlessly send money to their loved ones across 249 banks and 26 mobile money services in 11 African markets.

Unfortunately, it quickly became clear that this was neither sustainable nor scalable. As we grew, we encountered constant payment reliability issues. So, we started to dive a little deeper and get to the source of the problem.

Let’s start with customer retention 🪃

While the industry standard for 12-month customer retention stands at around 40%, NALA consistently outperformed this metric. (Source)

In the spirit of transparency, here is our monthly transacting customer retention rate:

You will notice from above that the more recent cohorts are a lot stronger than the earlier cohorts because we have started building better payout reliability. However, even with impressive retention rates.

I would personally call users who stopped using NALA to understand why, the #1 reason: Delayed transfers.

This glaring issue compelled us to seek a solution.

Delayed payments suck 😞

We started facing massive issues with payment failures, up to 15% more frequently. At the beginning when you are doing 100 transactions a day, it’s ‘fine.’ However, when you start doing 10,000+ transactions a day, this would be a massive headache as it would not scale our operations cost effectively.

Dependence on some external payment rails proved unsustainable. Between May 2023 and January 2024, we faced and average of 25 payment partner issues each month.

We would constantly find issues with float mismanagement, incorrect reconciliation handling, incorrect error messaging on API’s, webhook callbacks not working correctly, where some would tell us the money was delivered when it wasn’t and the customer would be even more upset at us as NALA.

It got to the point where it was almost clockwork. I'd wake up in the morning and ask, what payout partner will be down today? What are we going to tell customers today?

What we heard from customers.

These are tough to share but i think it’s important i shed light transparently on an issue that all remittance companies to Africa face: payment reliability.

As the founder and CEO of this business, reading this feedback from customers is challenging, it does keep me up at night at times and i often will scroll through these messages shared with me directly and personally try to respond to customers.

These reliability issues cost us money, damage our reputation and massively affect our users’ experience — something needed to change.

Our difficulties weren’t unique to NALA. Conversations with fellow founders in the payments sector revealed the same payment reliability challenges.

So, how do we fix this problem 🧐

Get Licenses, direct integrations, better operations and building better software to scale.

Securing licenses is a crucial step in this journey. Understanding that regulatory compliance is paramount in fintech, we applied for nine licenses across Africa. To date, we have received them in three countries. The licensing process is a time-consuming one. (one averages 2 years per license in some countries)

When this happened, we started building direct integrations ourselves with better operations, reconciliation, error mapping, treasury management and ultimately communication with banks and mobile money services.

Over time, I would speak with my peers (other cross border payments founders) and they would ask me if they could use NALA for payouts as they heard we were more reliable (see below). We are one of the few fintech companies with a direct integration with Mpesa in East Africa.

Transactions on NALA require less human or support intervention than other folks in the market, which is a testament to our payment reliability. But, it still wasn’t good enough.

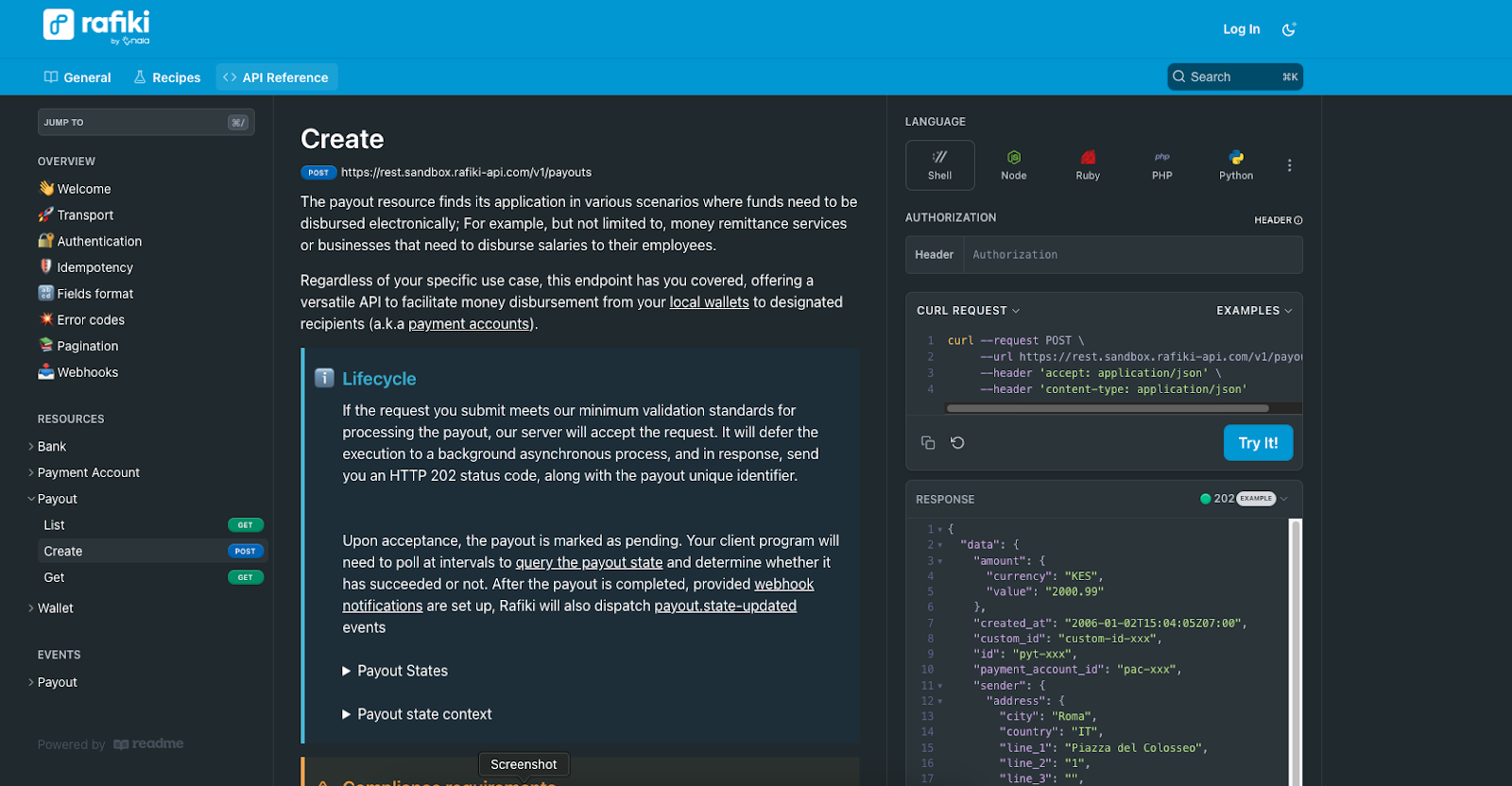

Introducing Rafiki API 🚀🩵

Rafiki — in Swahili means friend.

As a response, we made a pivotal decision: to develop our payment infrastructure. Thus, Rafiki by NALA was born — a B2B payments platform designed to ensure reliability, manage treasury directly, better error mapping, reduce user costs, and streamline payouts.

Like everything we do at NALA, we wanted our customer’s feedback and input at every stage of the build. While building Rafiki, we spent hundreds of hours with people who do large payouts to Africa such as remittance companies, payroll companies and global payout businesses.

To make it fun socially, I asked folks on Twitter to help us land on our logo.

Driven by the belief that if you want something done right, you must do it yourself, we’ve built Rafiki — a single API for global businesses to make payments into Africa.

We’re building for Africa what dLocal has done for LATAM and AirWallex/Nium for APAC.

This infrastructure, born not by choice, but rather out of necessity, is the backbone of our consumer fintech app and our B2B payments platform.

With Rafiki, we’re not just solving our own reliability issues; we’re also empowering global businesses to trade more effectively with Africa. By offering direct integration with banks and mobile money providers, Rafiki facilitates seamless cross-border payments, benefiting both senders and recipients.

How does Rafiki compare vs others?

As I write this, a large amount of our consumer fintech business pays out happen on Rafiki.

Here are our reliability stats from one of the existing payout partners in Africa vs. Rafiki by NALA for the last 5 months.

Blue is Rafiki; Red is a unicorn payments partner we have worked with in Africa. The difference is clear.

Remember, payment speed and reliability matters ⚡️

The speed at which recipients receive their money matters to users. With Rafiki, we deliver 99.3% of all transactions within 1 hour — most arrive in seconds. People are willing to pay a premium for high reliability.

Initially, Rafiki will focus on business payouts, with business collections coming later.

Today, Rafiki gives customers treasury management and reliable payouts on an all-in-one platform.

The problem is only getting bigger.

Africa is the fastest-growing region in the world, on track to hit 2.5 billion people by 2050.

The payment opportunity in Africa is massive due to the swiftly growing population, a large shift from physical to digital, and increased connectivity–Africa with other Continents. With the current infrastructure, if we don’t fix these issues today, the problem will only get bigger and bigger.

What’s next?

As we look to the future, Rafiki opens doors to broader opportunities. We’re exploring payment processing for businesses, aligning with our mission to build Payments for the Next Billion. Through Rafiki, we’re poised to address the reliability problem at scale, ushering in a new era of financial inclusivity and efficiency for global businesses operating within Africa.

So how do we manage both NALA consumer app and our infrastructure business? We split up the company, separate AWS, separate engineering team, ops and org structure so they can operate independently, make decisions fast and execute efficiently. This is hard to do, but the best call for the businesses to be successful. NALA consumer app turns into a customer of Rafiki.

In the coming months, we’ll unveil exciting partnerships with global payments and remittance companies, further solidifying Rafiki’s position in the fintech landscape. But if we don’t act now, the issues will only escalate.

We need your help. 🙏🏼

Let us know if you would be interested in giving us product feedback to help shape Rafiki and be part of the next chapter in African payments. Head over to our website to learn more and request early access. Check out our API documentation here, and share feedback on what we can do better.

Building in Africa is challenging. Payments don’t need to be.

At NALA, we’re committed to shaping the future of finance in Africa and beyond. With Rafiki API, we’re not just building a platform; we’re paving the way for transformative change, one reliable payment at a time.

Join us on this journey, and together, let’s redefine the possibilities of global businesses transacting with Africa.

Let’s Build 🩵🚀

See Techcrunch article on Rafiki here.